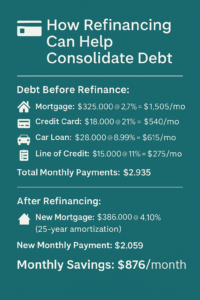

If you’ve followed this series, you know that refinancing your mortgage can help reduce monthly payments, consolidate debt, and provide flexibility during uncertain times. But how does the process actually work?

This week, we break down the refinance process step by step, so you know exactly what to expect — from the first conversation to funding day.

Step 1: The Initial Assessment

It all starts with a conversation.

We’ll review:

-

Your current mortgage balance, rate, and term

-

Other debts (credit cards, car loans, lines of credit)

-

Your income, property value, and credit score

-

Your goals: lower payments, debt consolidation, access to equity, etc.

If refinancing looks like a good fit, we’ll run numbers to show you what’s possible — including estimated payments, penalties (if any), and how the structure could work over 30 years with today’s uninsured rates (currently averaging 4.44% — accurate at time of publishing, subject to change).

Step 2: The Application

Once you’re ready to proceed, we submit a formal application to the most suitable lender based on your profile. Documents you may need:

-

Recent mortgage statement

-

Income verification (pay stub or T4; NOA if self-employed)

-

Property tax bill

-

Current home value (often verified with an appraisal)

We’ll also review how much equity is available — in Canada, most lenders allow up to 80% of your home’s appraised value for a refinance.

Step 3: Review & Approval

Once submitted, the lender will:

-

Verify your credit and debt ratios

-

Review your income and property details

-

Order an appraisal if required

If approved, you’ll receive a mortgage commitment outlining the rate, term, amortization (up to 30 years), prepayment privileges (typically up to 15% annually), and any applicable fees or conditions.

At this stage, we’ll walk through everything together to make sure it aligns with your goals.

Step 4: Legal & Closing

Once the commitment is signed:

-

We coordinate with your lawyer (or title company) to register the new mortgage

-

Any old mortgage is paid out

-

If consolidating debt, the lender pays out your credit cards, loans, or lines directly

Funding typically happens within 1–2 weeks after signing, depending on the lender and how quickly documents are finalized.

Step 5: You’re Done — With One Clean Payment

After closing, your first new mortgage payment begins within 30 days. From here, you enjoy:

-

One simple payment

-

Better cash flow

-

Ongoing flexibility (with open prepayment options up to 15% annually in most cases)

You’ll also receive new login details to track and manage your mortgage online — just like before.

Final Thoughts

Refinancing may sound complex, but when done right, it’s a streamlined process designed to give you breathing room and financial confidence.

Whether you’re looking to simplify, save, or restructure — refinancing in 2025 is less about chasing the lowest rate and more about choosing the right structure for your life.

Have questions or want to see if refinancing could help you?

Let’s talk — no pressure, no obligation.