In today’s market, refinancing isn’t just about chasing a lower interest rate — it’s about gaining control over your financial future. With high living costs, rising debt balances, and shifting home values, many homeowners don’t realize they already have access to a solution.

Here are the Top 5 signs it may be time to refinance your mortgage:

1️⃣ You’re Carrying High-Interest Consumer Debt

If your credit cards, car loans, or unsecured lines of credit are eating away at your cash flow, you’re not alone. Many Canadian households are paying 19%+ interest on credit cards, with payments adding up to $1,000 or more per month.

📉 A mortgage refinance at today’s average uninsured rate of 4.4% (accurate at time of publish, subject to change) can cut your monthly costs dramatically and help you rebuild savings or reduce financial stress.

2️⃣ Your Mortgage Term Ends Within the Next Year

Approaching the end of your current mortgage term? Most lenders allow early renewal within 3–6 months of maturity — sometimes even earlier. This is the ideal time to blend-and-extend, refinance without large penalties, or restructure your debt portfolio with minimal disruption.

3️⃣ You Need to Lower Monthly Payments

Whether you’re experiencing reduced income, rising expenses, or just want more breathing room, extending your amortization to 30 years during a refinance can be a powerful tool.

⚠️ Many lenders I work with allow 15% annual lump-sum prepayments, so you still have the flexibility to pay more when you can — without being locked into a higher monthly obligation.

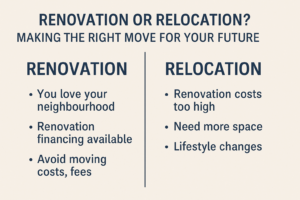

4️⃣ You’re Planning Renovations or Major Expenses

If you’re preparing to do renovations, pay for your child’s post-secondary education, or cover unexpected costs, refinancing may be more cost-effective than tapping credit cards or lines of credit.

Using your home equity now — while home values remain strong — gives you access to low-interest capital that can be reinvested into your property or future.

5️⃣ You’re Thinking of a Second Property or Investment

If you’ve considered buying a rental property, cottage, or vacation home, tapping into your equity through a refinance can give you the down payment you need. I regularly work with clients looking to reposition their equity into income-generating assets.

✅ Final Thoughts

Refinancing doesn’t always mean you’ll get a lower rate than your current mortgage — but it might still be the best decision. The goal is to improve your cash flow, protect your credit, reduce risk, and create opportunity.

If any of these triggers apply to you, it’s time to explore your options.