Introduction:

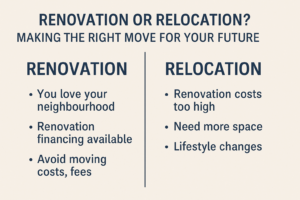

Homeowners often reach a point where their current space no longer suits their needs. Whether it’s a growing family, aging property, or simply a desire for something new, the big question becomes: Should you renovate or relocate? In today’s high-rate environment, making the right decision could have a major impact on your financial health.

The Case for Renovating:

Renovations can help you tailor your home to your evolving needs while potentially boosting its value.

Why Renovate?

-

You love your neighbourhood, school district, or commute.

-

You’ve built significant equity and want to reinvest in your current property.

-

Renovation financing may be easier than qualifying for a new mortgage at today’s rates.

Financial Considerations:

-

A refinance can provide access to equity for renovation funds.

-

Many lenders offer purchase plus improvements or refinance plus improvements options.

-

Renovations typically do not incur land transfer tax or realtor fees.

The Case for Relocating:

Sometimes starting fresh makes more sense—especially if your current home can’t be modified to suit your needs.

Why Relocate?

-

Renovation costs exceed the value they’ll add.

-

You need more space or a completely different layout.

-

You’re downsizing or changing lifestyle.

Financial Considerations:

-

You may be able to port your mortgage if rates and terms make sense.

-

Consider moving costs, legal fees, land transfer tax, and the higher rates associated with new mortgage debt today.

What to Watch:

-

Interest Rate Risk: Today’s average refinance rate is around 4.40% uninsured (as of time of publishing), meaning your new payments may be higher—even if you downsize.

-

Appraisal & Equity: Renovation lending is usually based on as-is and as-improved value. Ensure your plans align with what an appraiser will support.

-

ROI on Renovations: Kitchens and bathrooms typically yield the highest return, while pools or luxury upgrades may not recoup their cost.

Final Thoughts:

Every homeowner’s situation is unique. A refinance for renovations could be the smarter move for some—while others might benefit from a strategic relocation. Understanding both options helps you make the right financial call, not just the emotional one.