As 2025 winds down, many homeowners are asking a smart question: How do I protect my household finances going into 2026? With mortgage renewals ahead, ongoing global uncertainty, and household costs that remain high, fall is the perfect season to build a financial safety net.

🏦 Step 1: Review Your Mortgage Renewal Timeline

Even if your mortgage isn’t up for renewal until late 2026, starting early gives you options.

-

12+ months away: Track interest rate trends and prepare for changes.

-

6–12 months away: Begin talking to your broker about early renewal or refinance options.

-

Less than 6 months away: Compare lenders and products to avoid rushing at renewal.

💳 Step 2: Consolidate Debt Before It Grows

High-interest debt is the biggest threat to a household budget. Credit card balances above $800–$1,000 per month in payments can quickly spiral. Using home equity to consolidate this debt through a refinance could cut monthly obligations and improve cash flow heading into the new year.

🛠 Step 3: Plan for Emergencies & Maintenance

Unexpected repairs or job changes can derail financial stability. Setting aside even a small emergency fund, or creating room in your mortgage through a refinance or HELOC, ensures you don’t need to lean on credit cards when the unexpected happens.

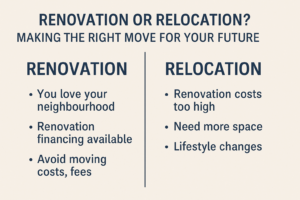

📈 Step 4: Use Equity Strategically

Equity can be a safety net, but also an opportunity. Whether it’s funding a basement rental suite for extra income, paying for your child’s education, or investing in a second property, refinancing to unlock equity can build long-term stability when done responsibly.

🌱 Step 5: Create Flexibility in Payments

With many lenders allowing 30-year amortizations and up to 15% in annual prepayments, you can build flexibility into your plan:

-

Pay less when times are tight

-

Pay more when cash flow allows

This balance creates resilience in your financial strategy.

Final Thoughts

A financial safety net isn’t just about savings — it’s about structure. By aligning your mortgage, debt, and equity with your long-term goals, you can reduce stress and set yourself up for a stronger 2026.

📲 Ready to build your financial safety net? Let’s review your mortgage and equity options before year-end.

Visit mortgage-wealth.ca – Your Home, Your Future, My Priority.