Refinancing isn’t just about chasing a lower rate. In 2025, it’s about cash flow, debt consolidation, and flexibility. With today’s uninsured 5-year fixed rates averaging around 4.44%

(accurate at time of publishing – subject to change), and with the option to amortize over 30 years, many Canadian homeowners are using refinancing to relieve pressure and reset their financial picture.

Why a 30-year amortization?

The lenders I work with often offer 30-year amortizations with 15% annual prepayment privileges. That means you have the freedom to pay more when things are good, or scale back to minimum payments without penalty when cash is tight.

This week, we’re highlighting three real-world-style examples that show how homeowners saved between $800 to over $1,000 a month — even when their new mortgage rate was higher than their previous one.

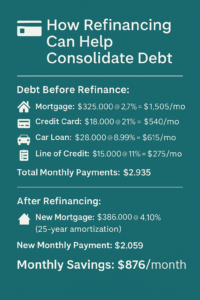

Case 1: Consolidating High-Interest Debt

Mike & Sarah – Niagara

Before Refinance:

-

Mortgage: $320,000 @ 2.79% → $1,741.26/month

-

Credit cards and car loan: $890/month combined

-

Total monthly outflow: $2,631.26

After Refinance:

-

New mortgage: $355,000 @ 4.44%, 30-year amortization

-

New monthly payment: $1,786.10

-

Monthly savings: $845.16

Why it worked:

Even though Mike and Sarah moved to a higher interest rate, eliminating 20% credit card debt and a nearly 9% car loan gave them a huge cash flow improvement. They now have one payment, and flexibility to pay more if they choose.

Case 2: Locking in Predictability After Rate Spikes

Jaspreet & Aman – Mississauga

Before Refinance:

-

Mortgage: $500,000 @ 6.00% (variable rate)

-

Monthly payment: $3,582.16

-

No other debts

After Refinance:

-

New mortgage: $500,000 @ 4.44%, 30-year amortization

-

New monthly payment: $2,515.63

-

Monthly savings: $1,066.53

Why it worked:

They originally had a great variable rate, but when the Bank of Canada raised rates, their payments skyrocketed. By refinancing into a fixed rate at a lower level, they locked in peace of mind — and saved over $1,000/month.

Case 3: Creating Breathing Room

Denise & Alex – Hamilton

Before Refinance:

-

Mortgage: $200,000 @ 3.5%, with 10 years remaining

-

Monthly payment: $1,977.72

-

Line of credit: $10,000 @ 8% → $65/month (interest-only)

-

Total monthly outflow: ~$2,043

After Refinance:

-

New mortgage: $210,000 @ 4.44%, 30-year amortization

-

New monthly payment: $1,056.57

-

Monthly savings: $986.43

Why it worked:

With a child starting university and reduced income, Denise and Alex needed to free up monthly cash flow. Re-amortizing the mortgage over 30 years and rolling in the line of credit gave them almost $1,000/month in relief — with no penalties if they choose to pay more in future years.

Final Thoughts

A refinance in today’s market isn’t just about getting a better rate — it’s about reshaping your mortgage to fit your life.

Whether you’re carrying high-interest debt, needing breathing room, or simply looking to regain financial control, refinancing with a flexible, long-term strategy can make all the difference.

And with today’s lenders offering extended amortizations and prepayment flexibility, you can stay in control — whether you want to pay off faster or slow down when needed.