For many, juggling multiple payments on credit cards, auto loans, and lines of credit is overwhelming.

Refinancing can be the solution—not to get a lower mortgage rate, but to simplify finances and reduce total monthly outflow by consolidating debt into one manageable payment.

📉 Why Consolidate Debt Through a Refinance?

Instead of making multiple payments to lenders charging 8%, 12%, or even 21% interest, you may be able to roll those balances into your mortgage at a rate closer to 4–5%, depending on your credit and equity.

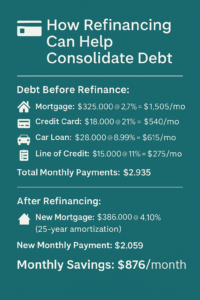

Here’s what that can look like in real terms:

🧾 Realistic Example – Debt Before Refinance:

-

Mortgage: $325,000 @ 2.79% = $1,505/month

-

Credit Card: $18,000 @ 21% = $540/month

-

Car Loan: $28,000 @ 8.99% = $615/month

-

Line of Credit: $15,000 @ 11% = $275/month

-

Total Monthly Payments: $2,935

🏡 After Refinancing:

-

New Mortgage: $386,000 @ 4.10% (25-year amortization)

-

New Monthly Payment: $2,059

-

Monthly Savings: $876/month

You’ve eliminated all high-interest payments and replaced them with a single mortgage payment at a lower blended rate.

🛠️ When This Strategy Works Best

Refinancing to consolidate debt is most effective when:

-

You have strong equity (typically at least 20%)

-

Your credit is still in good standing

-

You’re looking to free up cash flow or prevent missed payments

-

You want to simplify your monthly obligations

Even if your new mortgage rate is higher than your current one, the overall interest savings and stress relief can be substantial.

🚫 When to Pause

Refinancing to consolidate debt may not be ideal if:

-

You’re early in your mortgage term and facing large penalties

-

Your home equity is low

-

Your income has dropped significantly, affecting qualification

In those cases, a second mortgage or private lending solution may be better—especially short-term.

💬 Final Thoughts

High-interest debt doesn’t just drain your bank account—it affects your mental space. A strategic refinance can be the key to restoring balance, regaining cash flow, and setting your financial life on a new track.

Every case is unique. Even if refinancing isn’t the final solution, it’s worth a conversation to explore your options before debt becomes unmanageable.